I am tired of this lack of stability. Today I feel untop of the world, 30 Billion for the Account! Well actually not that much. The point is I struggle with the Spend Right Now Syndrome. I know you are wondering which one is the Spend right now Syndrome? Are you the kind of person that when you get a credit alert you feel untop of the world? You feel like the richest person in the world. You can afford anything. You remember all your needs ( or wants if you are truthful to yourself). With the new advent of ATM and Internet banking it's safe to say the "Akant balance" does not stay up for long. Tha banks are ready to make us us spend. If your mobile number is attached to your account and you can buy credit on your phone then you are in a deeper pit 😂😂. Let me not start with the *737*Clique. They don't need Internet to even withdraw all their money 😂😂😂😂

My mum and I went out one fateful day and well let's say we did not return home with the side mirror intact. My mum had to fix it as soon as possible, so the next day she went out and paid to fix it. I looked at myself and wondered, if someone should bash me today can I afford to fix a car?

I had to go to the hospital on short notice. Hospitals these days though! How much is our salary that medical care is so expensive. I had to check myself, can I afford my own health care. Truth be told health issues are usually emergencies. It's not like birthdays that you can save and plan for it.

The youths of today are always quick to complain and blame their lack of saving spirit on the low salary they receive. " I only earn 90k, when I buy fuel... etc what is left?" My dad always tells me the minimum wage of your country is N 18,000 and families have to survive on that. It gives me worry

As to what the problem is. Why can't I save? Why do I plan how to spend money before it enters my account?

Every New year I tell myself I am going to have X amount in my savings account at the end of the year. Right now I am zero percent close to reaching my goal. I have tried so many steps and they

have failed. Some include;

• Opening an Account and not getting a debit card for it

• Having a piggy Bank

• Telling my roommate to hold money for me

• Promising myself I will Save after spending on the necessities.

• Leaving money in the pockets of my clothes so that when I wear them I'll get a surprise (it works a little)

You cannot save after spending. Only God knows where I got such a ridiculous idea. I believe if you truly want to save, after paying your tithe remove the percentage you want to save. Obviously that is not enough but after searching for a solution luck smiled on me, PIGGYBANKNG!! I know you are wondering what is that.

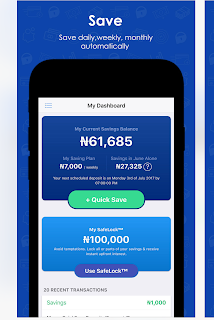

Piggy Bank Ng ( Powered by UBA Bank) is an app available on all our phones where we can save directly from our account. You can set your app to automatically debit your account or you can debit into your piggybank account at your own time. There is a particular percentage that is added to your account based on how many days you decide to save the money. You have the option to withdraw money 4 times a year or a day you set. Withdrawing outside that day will attract a 5% penalty. There also exists a safelock option. This is similar to fixed deposit. Once you safelock your money you have no access to. It until the date set arrives. You also receive the interest upfront.

Honestly if the penalty does not deter you from withdrawing then nothing can. It is also amazing to see your savings increasing. For someone who loves winning I love to see myself superseding the targets I've set for myself. So if I set 3000 Naira per month, I want to be able to save that much or more. Where you fail to reach your target the app turns red. You don't want that now do you?

We should also check our statement of Account monthly. Sometimes the bank can debit you twice and you will never know because you never check your statement of account.

I'm still open to new ideas on how to save money. Any clues?

No comments:

Post a Comment